Our Daily Bread

4.2

Shopping Frog Stickers

0.0

Quiet Time Bible

4.7

SenPlayer - HDR Media Player

4.7

My Spectrum

4.6

AI Cartoon Avatar: Cartoonly

0.0

Web Video Cast | Browser to TV

4.8

SwingTool - Swing Weight

4.3

DrawPlan

3.3

Simple Grocery Planner

0.0

myCSC

2.0

Kids App Qustodio

2.0

Ghost Detector Radar Simulator

4.1

Bluetalk: Bluetooth Messenger

5.0

Backtrack Magazine

2.5

iPlum: Business Phone Number

4.3

Free Audiobooks Pro- 4,727 audiobooks to go.

4.2

Yacine : Match

4.4

DeepDish GigBook

3.0

Record Searchlight

3.9

OpenTable

4.8

RaceWeek: Formula Widgets

5.0

NW Ferry

4.7

AEM Driver

0.0

Home

/

Stride

ADVERTISEMENT

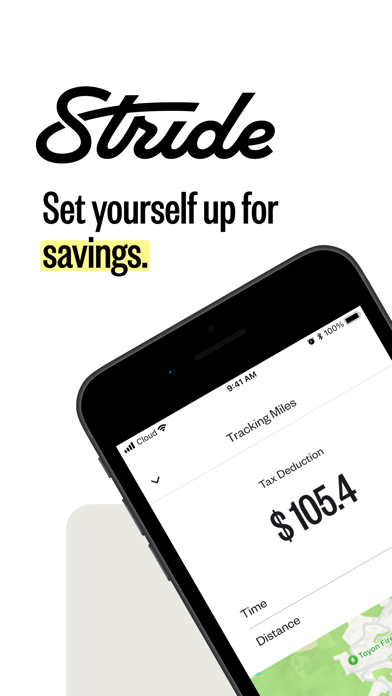

Stride

2.4

Updated

Aug 19, 2024

Developer

Stride Health / Stride Health, Inc

OS

IOS / Android

Category

Finance

What do you think of this app?

That's Good

General

Not Good

ADVERTISEMENT

Good App Guaranteed:

This app passed the security test for virus,malware and other malicious attacks and doesn't contain

any theats.

Description:

**Stride: Free Mileage and Tax Tracker for Independent Workers**

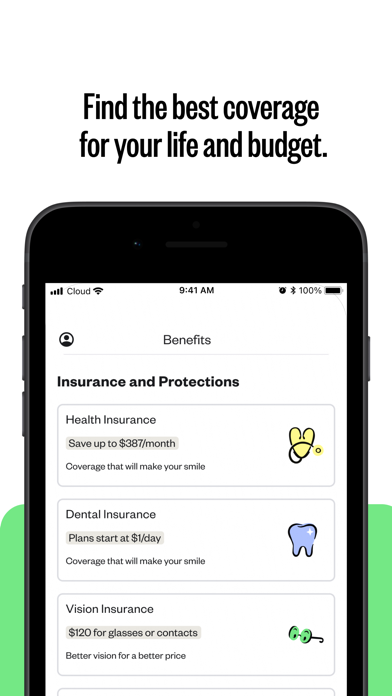

Stride is a free, easy-to-use app designed to help independent workers track their business miles and expenses, making tax time simpler and more profitable. With Stride, you can automatically track your mileage, log business expenses, and maximize your tax deductions, potentially saving thousands of dollars each year.

**Key Features:**

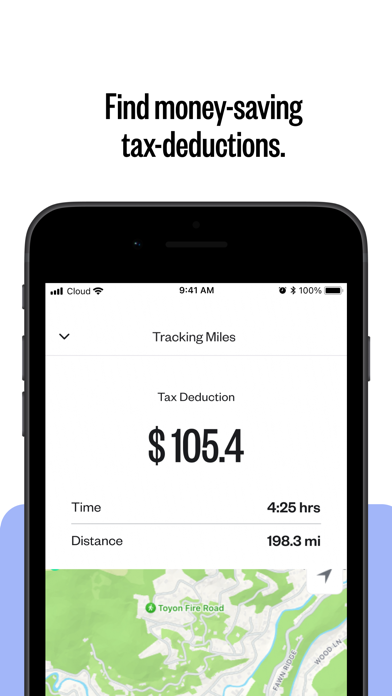

- **Automatic Mileage Tracking**: Simply press "Start" when you begin driving, and Stride will automatically track your miles using GPS, ensuring you capture every deductible mile in an IRS-ready format.

- **Expense Logging**: Keep track of all your business expenses, from car washes to phone bills. Stride helps you identify deductible expenses based on your work, making it easier to save on taxes.

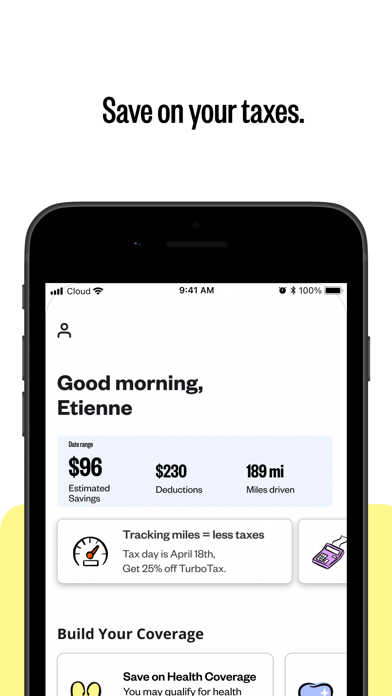

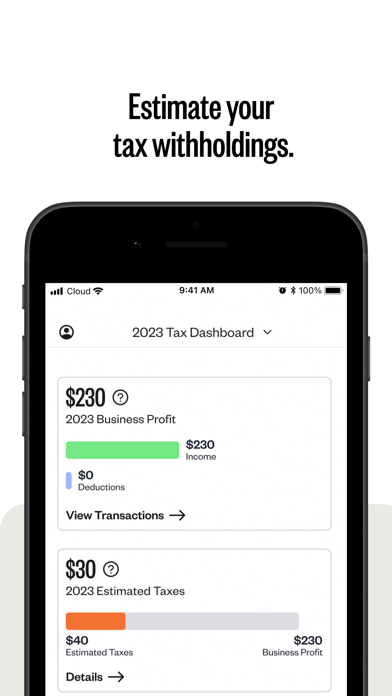

- **Maximize Tax Savings**: On average, Stride users save $4,000 or more at tax time. The app finds potential write-offs and deductions tailored to your business activities, helping you reduce your tax bill.

- **IRS-Ready Tax Reports**: Stride prepares all the information you need to file your taxes, providing you with IRS-ready reports that can be used with any filing method, whether you e-file, use tax software, or work with an accountant.

- **Hassle-Free Filing**: Stride simplifies the tax filing process by gathering all necessary data in one place, helping you audit-proof your taxes and file with confidence.

Stride is perfect for a wide range of independent workers, including rideshare drivers, delivery drivers, entertainers, creative professionals, business consultants, real estate agents, and more. Whether you're self-employed or have a side hustle, Stride helps you keep more of what you earn by making tax tracking and filing easier than ever.

How to use:

**Stride App User Guide**

Welcome to Stride, your free mileage and tax tracker designed to help independent workers manage their business expenses and maximize tax savings. This guide will walk you through how to use the Stride app effectively.

### 1. **Getting Started**

**Download and Install the App:**

- Visit the App Store or Google Play Store and search for "Stride."

- Download and install the app on your smartphone.

**Create an Account:**

- Open the Stride app and tap “Sign Up.”

- Enter your email address and create a password, or sign in using your Google or Apple account.

- Complete your profile by entering basic information about your work.

### 2. **Tracking Mileage**

**Start Tracking Your Miles:**

- On the home screen, tap “Start Tracking” when you begin driving for work.

- Stride will automatically use GPS to track your mileage.

- To stop tracking, tap “Stop Tracking” when you’ve completed your trip.

**Set Up Mileage Reminders:**

- Go to “Settings” and enable notifications to remind you to start tracking at specific times.

**View Your Mileage Logs:**

- Tap on “Mileage” to view a log of your tracked miles. Stride organizes your trips into an IRS-ready format, making it easy to see how much you’ve saved on taxes.

### 3. **Logging Expenses**

**Add Business Expenses:**

- On the main dashboard, tap “Add Expense.”

- Select the category that best fits your expense (e.g., car maintenance, meals, supplies).

- Enter the amount and any additional details, such as the date and description, then save the expense.

**Integrate Your Bank Account:**

- To automatically import expenses, go to “Settings” and link your bank account.

- Stride will help you identify deductible expenses and add them to your logs.

**View and Manage Expenses:**

- Tap on “Expenses” to see all your logged expenses. Stride provides in-app guidance on which expenses are deductible, helping you maximize your tax savings.

### 4. **Preparing for Tax Filing**

**Generate an IRS-Ready Tax Report:**

- When you’re ready to file your taxes, go to the “Tax Report” section.

- Stride will generate a comprehensive report that includes all your tracked mileage and expenses.

- You can export this report to use with tax filing software, e-file, or provide it to your accountant.

**Audit-Proof Your Taxes:**

- Stride ensures that your records are detailed and organized in an IRS-compliant format, reducing the risk of an audit.

### 5. **Maximizing Tax Deductions**

**Discover Potential Write-Offs:**

- As you log expenses, Stride will suggest potential tax deductions based on your work.

- Review these suggestions in the “Expenses” section to ensure you’re not missing out on savings.

**Monitor Your Savings:**

- Check the “Savings” section to see an estimate of how much you’ve saved on taxes by using Stride. The app updates this figure as you track mileage and log expenses.

### 6. **Additional Features**

**Use Stride for Different Professions:**

- Stride is designed for a wide range of independent workers, including rideshare drivers, freelancers, consultants, and more.

- Customize your expense categories and tracking preferences based on your specific work needs.

**Get Support:**

- If you need help, access the “Help Center” in the app for FAQs and tips.

- For further assistance, contact Stride’s customer support through the app.

### 7. **Account Settings**

**Update Personal Information:**

- Go to “Settings” to update your profile, adjust notifications, and manage your linked accounts.

**Secure Your Account:**

- Enable biometric login (fingerprint or face recognition) in “Settings” for added security.

With this guide, you’re ready to take full advantage of Stride’s features to track your business miles, log expenses, and maximize your tax savings effortlessly. Enjoy managing your independent work with ease using Stride.

Get the app

App Store

Link provided by App Store

Google Play

Link provided by Google Play

Leave a comment

Send Comment

Comments (0)

IOS

Android

Version:

24.8.0

Size:

105.47MB

Price:

Free

Released:

Oct 12, 2015

Updated:

Aug 19, 2024

ADVERTISEMENT

Fun online games

Food And Delivery Trucks Jigsaw

Beach Volleyball

Farming 10x10

Soccer Heads

Ice Cream Making

Dont Miss

xDrive iPerformance Puzzle

Mortal Cage Fighter

Rock Ninja

Epic Race 3D

Dodge The Tower

First Aid For Car Accident

Balloon Hero

Trials Ice Ride

Blazing Wheels

Traffic.io

Moto Maniac 3

Drift Car to Right

Paperio 3

Extreme Water Floating Bus

Tasty Jewel

Fix My Phone

Become a dentist

Block Puzzle Classic

This website uses cookies to ensure you get the best experience on our website. Learn more

Got it!